In today’s rapidly evolving digital landscape, real-time alerts have become absolutely crucial for maintaining the security and efficiency of digital banking. These alerts provide immediate notifications of account activity, allowing customers to quickly identify and respond to potentially fraudulent transactions, unusual spending patterns, or important account updates. This proactive approach to security is paramount in mitigating risks and safeguarding financial assets in the ever-present threat of cybercrime and fraud. Embracing the power of real-time alerts empowers customers with the knowledge and control necessary to protect their finances effectively in the dynamic world of digital banking.

Beyond security, real-time alerts play a pivotal role in optimizing financial management within digital banking platforms. By providing instant updates on account balances, payment confirmations, and upcoming due dates, these alerts empower customers to maintain better control over their finances. This timely information enables proactive budgeting, prevents missed payments, and facilitates informed financial decision-making. The convenience and efficiency offered by real-time alerts transform the digital banking experience, providing customers with a seamless and personalized approach to managing their financial well-being.

What Are Real-Time Alerts?

Real-time alerts are instantaneous notifications delivered to a user regarding specific activities or events occurring within their digital banking account. These alerts are triggered the moment a pre-defined action takes place, providing immediate awareness of account changes.

These alerts can encompass a wide range of activities, from low balance warnings and deposit confirmations to suspicious activity notifications and large transaction alerts. The immediacy of these alerts allows users to proactively manage their finances and quickly respond to any potentially fraudulent or unauthorized transactions.

Monitor Transactions Instantly

Real-time alerts empower you with immediate oversight of your financial activities. This instantaneous monitoring capability is a cornerstone of secure digital banking. You’re notified of every transaction the moment it occurs, allowing you to quickly identify and address any unauthorized or suspicious activity.

Imagine your debit card being used in a different state while you’re at home. A real-time alert informs you immediately, enabling you to contact your bank and freeze your card, potentially preventing significant financial loss. This level of immediacy is crucial in today’s fast-paced digital world.

Beyond security, real-time transaction monitoring also provides valuable budgeting and spending insights. By receiving instant notifications, you can maintain a closer watch on your account balance and spending habits, facilitating more informed financial decisions.

Detect Fraud Early

Real-time alerts play a crucial role in the early detection of fraudulent activities. Immediate notification of suspicious transactions allows customers and financial institutions to take swift action, minimizing potential losses.

Traditional fraud detection methods often rely on batch processing, which can result in delays of hours or even days before fraudulent activity is identified. This lag time gives fraudsters ample opportunity to exploit compromised accounts and inflict significant financial damage.

By contrast, real-time alerts empower customers to immediately verify transactions and report any unauthorized activity. This rapid response can effectively stop fraudulent transactions in their tracks, preventing further losses. For financial institutions, real-time alerts enable proactive intervention, such as blocking suspicious transactions or freezing compromised accounts, safeguarding both the institution and its customers.

Stay Within Budget

Real-time alerts play a crucial role in helping users maintain control of their finances and stay within their predetermined budget. Instant notifications of transactions, whether debit or credit, provide immediate awareness of spending patterns. This up-to-the-minute insight allows for proactive adjustments to spending habits, preventing overdrafts and promoting responsible financial management.

Customized alert thresholds empower users to set boundaries for specific spending categories. For instance, an alert can be triggered when spending on dining out reaches a certain limit. These personalized alerts serve as timely reminders, enabling users to make informed decisions and avoid exceeding their budgetary constraints.

By offering immediate feedback on spending activity, real-time alerts contribute significantly to improved budgeting practices. Users can quickly identify areas of overspending and take corrective action. This proactive approach fosters greater financial awareness and promotes responsible long-term financial health.

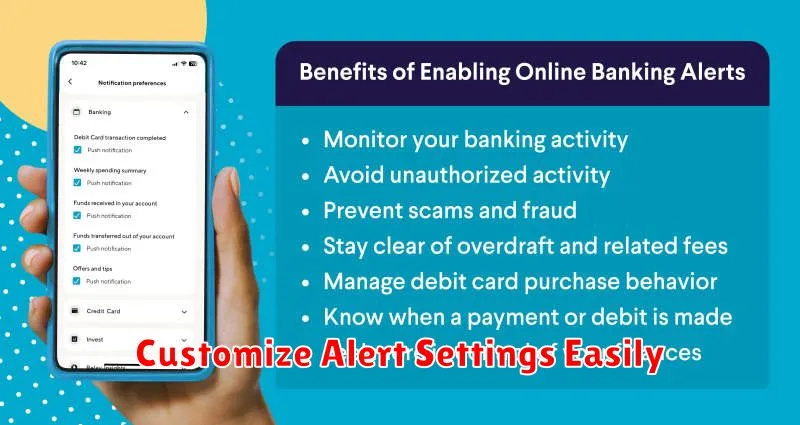

Customize Alert Settings Easily

One of the key benefits of real-time alerts is the ability to customize them to your specific needs. Most digital banking platforms offer a range of alert options, allowing you to choose which notifications you receive and how you receive them.

Typically, you can select from various alert categories such as security alerts (e.g., login attempts, password changes), account activity alerts (e.g., deposits, withdrawals, low balance), and transaction alerts (e.g., specific purchase amounts, international transactions).

You can also customize the delivery method. Choose to receive alerts via email, SMS message, push notification, or a combination of these. This flexibility ensures you receive critical information in the way that’s most convenient for you.

Furthermore, you can often set thresholds for certain alerts. For example, you can set a low-balance alert to trigger when your account balance falls below a specific amount. This level of customization empowers you to stay informed and maintain control over your finances.