The Fintech industry is undergoing a period of rapid transformation, driven by groundbreaking innovations that are reshaping the financial landscape. From the rise of artificial intelligence and blockchain technology to the increasing prevalence of mobile payments and open banking, these key advancements are revolutionizing how we interact with financial services. This article delves into the most impactful innovations impacting the Fintech sector, exploring their current applications and potential future implications.

Understanding the key innovations driving the Fintech revolution is crucial for anyone involved in finance, technology, or business. This article will examine artificial intelligence (AI), blockchain, mobile payments, open banking, and other crucial Fintech innovations. By exploring these transformative technologies, we aim to provide valuable insights into the future of finance and how these innovations are poised to reshape the industry in the years to come.

AI and Machine Learning in Banking

Artificial intelligence (AI) and machine learning (ML) are rapidly transforming the banking industry, driving significant improvements in efficiency, security, and customer experience. These technologies are being applied across a wide range of banking functions.

Fraud detection is a key area where AI and ML excel. Sophisticated algorithms can analyze vast amounts of transaction data in real time to identify suspicious patterns and flag potentially fraudulent activities much faster and more accurately than traditional methods.

Customer service is also being revolutionized by AI-powered chatbots and virtual assistants. These tools can handle routine inquiries, provide personalized financial advice, and offer 24/7 support, freeing up human agents to focus on more complex issues.

Furthermore, AI and ML are enhancing risk management by enabling banks to develop more sophisticated credit scoring models and predict potential loan defaults with greater accuracy. This leads to more informed lending decisions and improved profitability.

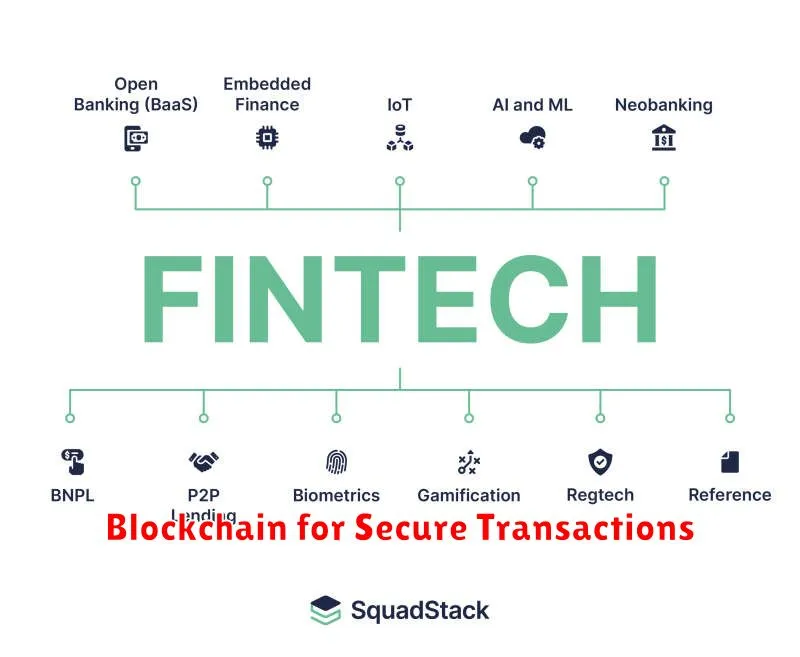

Blockchain for Secure Transactions

Blockchain technology has emerged as a transformative force in fintech, offering a new paradigm for secure and transparent transactions. Its decentralized and cryptographic nature enhances security by eliminating single points of failure and protecting against fraudulent activities.

Decentralization means that transaction data is distributed across a network of computers, rather than held by a central authority. This makes it extremely difficult for malicious actors to alter or manipulate the data.

Cryptography further strengthens security by encrypting transaction data and linking it cryptographically to previous transactions, creating an immutable record. This ensures the integrity and authenticity of the data.

Open Banking APIs

Open Banking, powered by APIs (Application Programming Interfaces), is revolutionizing the financial landscape. These APIs allow third-party developers to securely access customer financial data, with their explicit consent. This fosters competition and innovation by enabling the creation of personalized financial products and services.

Benefits of Open Banking APIs include enhanced customer experiences through tailored financial management tools, increased efficiency in processes like loan applications, and the emergence of innovative fintech solutions.

Examples of applications built on Open Banking include account aggregation apps that provide a consolidated view of a user’s finances across multiple institutions, and automated budgeting tools that offer personalized financial advice.

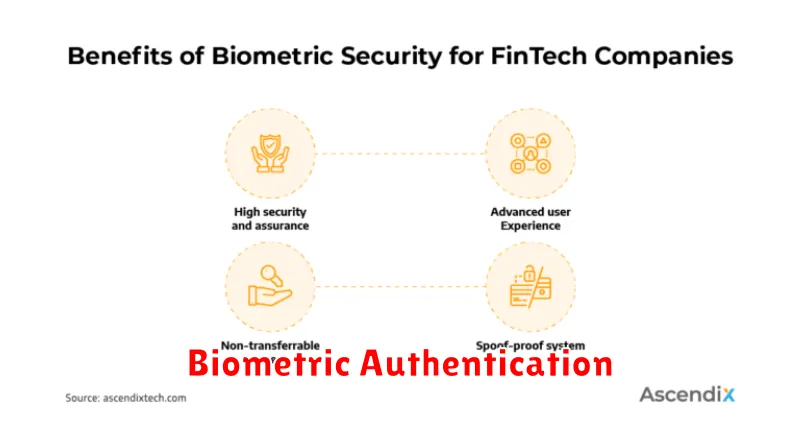

Biometric Authentication

Biometric authentication represents a significant advancement in Fintech security. This technology leverages unique biological traits for user identification and verification, offering a robust alternative to traditional passwords and PINs.

Various biometric modalities find application within the Fintech sector. These include fingerprint scanning, facial recognition, voice recognition, and iris scanning. By relying on inherent physical or behavioral characteristics, biometric authentication makes it significantly more difficult for fraudsters to impersonate legitimate users, thus enhancing the overall security posture of financial transactions.

The implementation of biometrics streamlines the user experience while simultaneously bolstering security. It eliminates the need to remember complex passwords and reduces the risk of account takeover due to stolen or compromised credentials. This enhanced security framework fosters trust among users, encouraging greater adoption of digital financial services.

The Rise of Neobanks

Neobanks, also known as digital banks, have emerged as a disruptive force within the financial landscape. These entirely digital institutions operate without physical branches, leveraging technology to offer a range of financial services through user-friendly mobile applications and online platforms.

Their appeal lies in their customer-centric approach. Neobanks frequently offer personalized experiences, lower fees, and streamlined processes for account opening and money management. This has attracted a significant, particularly younger, demographic seeking alternatives to traditional banking.

Several factors have contributed to the rise of neobanks. Increased smartphone penetration and comfort with digital transactions are key drivers. Furthermore, evolving consumer expectations for seamless and personalized financial services have fueled demand.