In today’s rapidly evolving digital landscape, digital wallets are becoming increasingly prevalent, transforming how we conduct financial transactions. Understanding digital wallets, their functionality, and the numerous benefits they offer is crucial for navigating the modern financial world. This article delves into the intricacies of digital wallets, exploring their various types, from basic mobile payment apps to sophisticated platforms incorporating cryptocurrency and other advanced features. We will examine the benefits of adopting digital wallet technology, including enhanced security, increased convenience, and seamless integration with emerging financial technologies.

From streamlined online shopping to contactless in-store payments, digital wallets offer a plethora of advantages over traditional payment methods. This exploration of digital wallet benefits will cover aspects such as reduced reliance on physical cards, improved transaction speed, and enhanced financial tracking capabilities. Whether you’re a tech-savvy individual or just beginning to explore the world of digital finance, this comprehensive guide will provide valuable insights into the world of digital wallets and empower you to make informed decisions about integrating them into your daily life.

What Is a Digital Wallet?

A digital wallet, also known as an e-wallet, is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. It essentially mimics the function of a physical wallet but in a digital format.

Digital wallets can be used to make online transactions, in-store contactless payments, and even store digital versions of identification documents, loyalty cards, and boarding passes. They offer a convenient and often more secure alternative to traditional payment methods.

Key features often include encryption and other security measures to protect user data. Many also offer transaction tracking and budgeting tools.

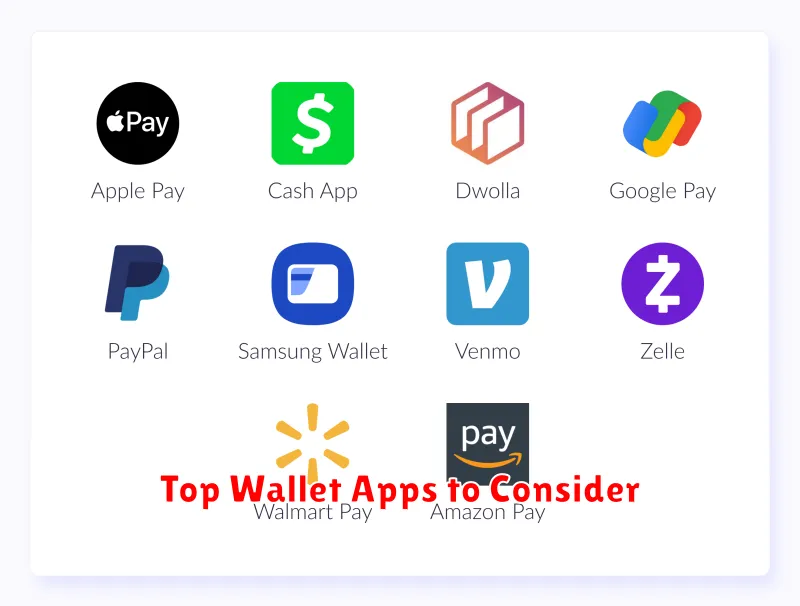

Top Wallet Apps to Consider

Choosing the right digital wallet depends on individual needs and preferences. Factors to consider include supported payment methods, security features, and availability in your region. Here are a few popular options:

Popular Choices

Apple Pay is a convenient choice for iPhone users, seamlessly integrating with existing Apple devices and offering strong security through biometric authentication.

Google Pay provides a versatile platform compatible with Android devices and offers a wide range of features, including peer-to-peer payments and loyalty program integration. It’s known for its user-friendly interface.

Samsung Pay caters specifically to Samsung device owners and supports Magnetic Secure Transmission (MST) technology, allowing it to work with older payment terminals alongside NFC. This gives it broader acceptance.

PayPal remains a widely accepted digital wallet, offering a robust platform for online transactions and person-to-person payments. It’s available on various devices and operating systems.

Security Features Explained

Digital wallets employ several security measures to protect your financial information. Two-factor authentication (2FA) adds an extra layer of security, requiring a second verification method like a one-time code sent to your phone. This makes it significantly harder for unauthorized access even if your password is compromised.

Biometric authentication, such as fingerprint or facial recognition, provides a convenient yet secure way to access your wallet. This technology adds a unique and difficult-to-replicate layer of security.

Tokenization replaces sensitive card details with unique tokens. When you make a purchase, the token is used instead of your actual card number, protecting your information from potential breaches at the merchant level.

Furthermore, many digital wallets offer transaction monitoring and fraud detection. These systems analyze your spending patterns and alert you to any suspicious activity, allowing you to quickly address potential issues.

How to Link and Use Your Wallet

Linking your digital wallet typically involves a few straightforward steps. First, download the wallet app of your choice from your device’s app store. Then, create an account, which often involves providing some personal information and setting up security measures like a password or biometric authentication.

Next, you’ll need to link your payment cards or bank accounts. This usually involves manually entering your card details or, in some cases, using your device’s camera to scan the card. Once linked, your wallet is ready to use.

To use your digital wallet for payment, simply open the app on your device and select the desired payment card. Depending on the payment terminal, you might tap your device on a contactless reader or scan a QR code displayed on the terminal screen. Confirmation of the transaction is usually provided both on the terminal and within your wallet app.

Benefits of Going Cashless

Embracing a cashless lifestyle offers a variety of advantages for both consumers and businesses. Convenience is a key factor, eliminating the need to carry physical cash and simplifying transactions. Paying with a tap of your phone or card is quicker and more efficient.

Enhanced security is another compelling benefit. Digital wallets often incorporate advanced security features like tokenization and biometric authentication, reducing the risk of theft and fraud compared to carrying physical cash. Furthermore, transaction history is readily available for tracking and budgeting purposes.

Going cashless contributes to improved hygiene, minimizing the handling of frequently touched banknotes and coins. This is particularly relevant in a health-conscious society.

From a broader perspective, a cashless society fosters economic growth by reducing the costs associated with handling and processing physical currency. This efficiency translates into benefits for businesses and the economy as a whole.