In today’s rapidly evolving financial landscape, the lines between traditional banking and digital financial services are becoming increasingly blurred. The rise of digital banks and neobanks has introduced innovative and disruptive solutions, challenging the established norms of the banking industry. Understanding the key differences between digital banks and neobanks is crucial for both consumers and businesses seeking to navigate this new financial terrain. This article will explore the nuances of each model, examining their unique features, advantages, and disadvantages, focusing on the core distinctions between a digital bank and a neobank.

While the terms “digital bank” and “neobank” are often used interchangeably, they represent distinct entities with varying characteristics. This article will delve into the core differences between digital banks and neobanks, clarifying their respective definitions, operating models, and target audiences. By understanding these differences, readers can make informed decisions about which type of financial institution best suits their specific needs and preferences, whether they are seeking a fully digital banking experience or a more traditional banking relationship augmented by digital tools. We will explore how digital banks and neobanks compare in terms of services, regulations, and overall customer experience.

What Are Digital Banks?

Digital banks are online-only versions of traditional banks. They offer the same core banking services as brick-and-mortar institutions but without physical branches. Customers access their accounts and manage their finances entirely through a website or mobile app.

These banks offer services like checking and savings accounts, loans, and money transfers, often with lower fees due to reduced overhead costs. While they lack a physical presence, many digital banks provide customer support via phone, email, or online chat.

Digital banks are often a branch or division of an established traditional bank, leveraging the parent company’s existing infrastructure and regulatory framework. This association provides them with a level of trust and stability that newer financial technology companies may not possess.

Understanding Neobanks

Neobanks are fintech companies that offer financial services, primarily or exclusively, through digital channels like mobile apps and websites. Unlike traditional banks, neobanks typically do not have physical branches. They partner with established banks to insure deposits, ensuring regulatory compliance.

Key Characteristics of Neobanks:

- Digital-first: Operate entirely online, offering 24/7 access to services.

- Lower overhead: Often have lower operating costs due to the lack of physical infrastructure.

- Specialized services: May focus on specific demographics or financial needs, such as budgeting or international money transfers.

- Agile and innovative: Quickly adapt to changing customer needs and technological advancements.

Neobanks aim to provide seamless and user-friendly banking experiences. They often leverage technology to offer personalized financial management tools, such as automated budgeting and spending analysis.

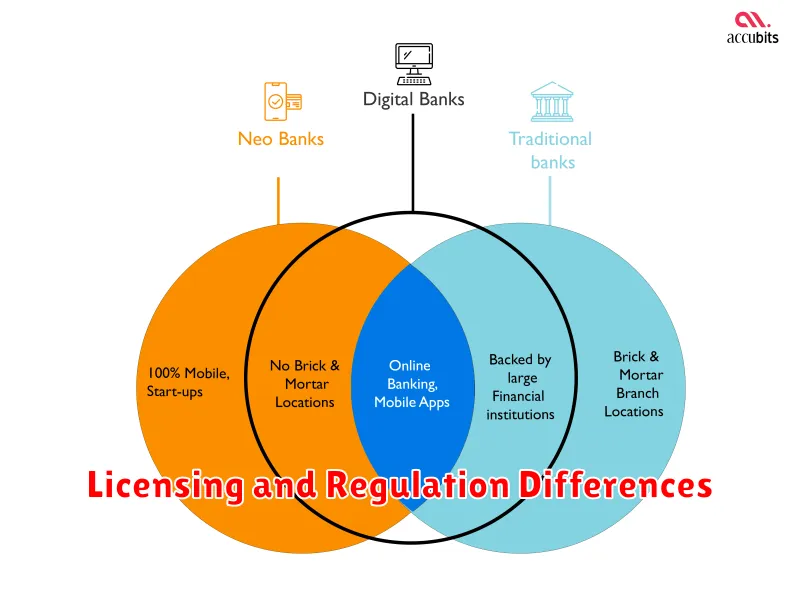

Licensing and Regulation Differences

A key distinction between digital banks and neobanks lies in their licensing and regulatory frameworks. Digital banks, as offshoots of traditional banks, operate under the same licenses and regulations as their parent institutions. This means they are fully regulated entities, subject to stringent oversight by existing financial authorities.

Neobanks, however, exhibit more variability in their regulatory approaches. Some neobanks obtain full banking licenses themselves, placing them under the same regulatory scrutiny as traditional banks. Others operate under specialized licenses, often focused on specific financial services like payments or money transfers. Finally, some partner with traditional banks, leveraging the bank’s existing license through a “banking-as-a-service” (BaaS) model. This allows them to offer financial products while relying on their partner’s regulatory compliance infrastructure.

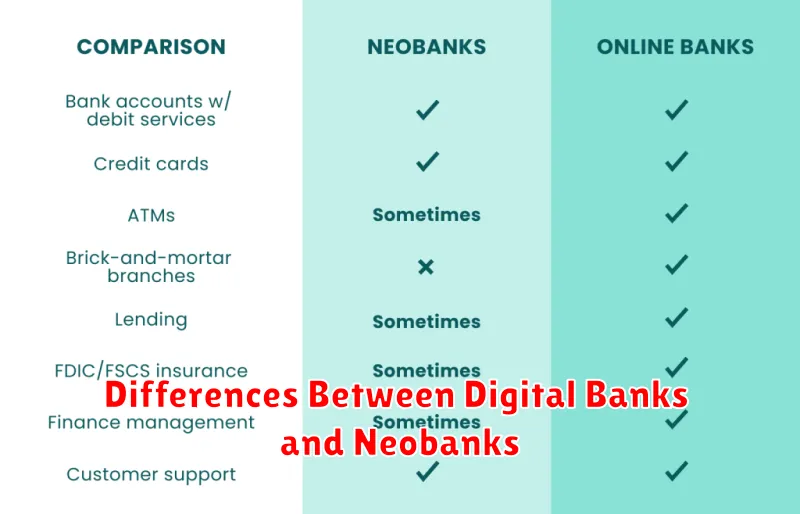

Features Comparison

While both digital banks and neobanks offer digital-first services, their feature sets can differ. Digital banks, typically extensions of traditional banks, offer a comprehensive suite of services comparable to their brick-and-mortar counterparts. These include checking and savings accounts, loans, credit cards, and investment options. They often integrate with existing bank infrastructure.

Neobanks, on the other hand, may offer a more limited range of services, frequently focusing on specific needs like spending management, budgeting, or international money transfers. They often prioritize user-friendly mobile interfaces and personalized features but might lack traditional services like physical branches or complex loan products.

| Feature | Digital Banks | Neobanks |

|---|---|---|

| Account Types | Checking, Savings, Money Market | Checking, Savings |

| Loans | Mortgages, Auto Loans, Personal Loans | Personal Loans, Credit Lines |

| Physical Branches | Often Available | Rarely Available |

| Investment Options | Usually Offered | Sometimes Offered |

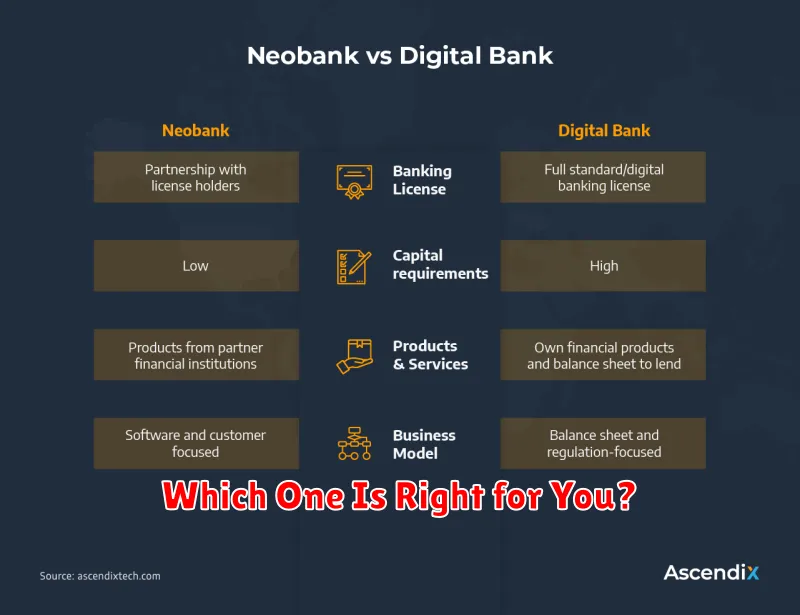

Which One Is Right for You?

Choosing between a digital bank and a neobank depends on your individual needs and priorities. Consider what features are most important to you.

Digital Banks

Digital banks are a good choice for customers who want the convenience of online banking with the security and established presence of a traditional institution. They are ideal if you occasionally need to access in-person services at a branch.

Neobanks

Neobanks are an excellent option for tech-savvy customers who primarily bank through their mobile devices and prioritize innovative features and potentially lower fees. Consider a neobank if you are comfortable managing your finances entirely digitally.

Ultimately, the best choice depends on your individual banking habits and your comfort level with technology.