In today’s rapidly evolving digital landscape, digital banking has become an indispensable part of our lives. The convenience of managing finances anytime, anywhere is undeniable. However, with this convenience comes the crucial question: How secure is digital banking? Understanding the potential risks and implementing effective security measures is paramount to safeguarding your financial information and protecting yourself from cyber threats. This article will delve into the security aspects of digital banking, exploring both the measures employed by financial institutions and the tips you can adopt to stay safe.

From online banking to mobile banking apps, the digital realm offers numerous avenues for managing your money. But with increasing instances of cybercrime, ensuring the security of your digital banking activities is more critical than ever. This article provides practical tips and insights to help you navigate the digital financial landscape securely. We will explore various security measures, from strong passwords and multi-factor authentication to recognizing phishing scams and protecting your devices. By understanding the potential vulnerabilities and adopting proactive security habits, you can significantly enhance the security of your digital banking experience and protect your financial well-being.

Understanding Digital Bank Security

Digital banking security involves multiple layers of protection implemented by banks and financial institutions to safeguard customer accounts and financial information. These measures work to prevent unauthorized access, fraud, and data breaches.

Encryption plays a crucial role. It scrambles data transmitted between you and the bank, rendering it unreadable to any intercepting parties. Multi-factor authentication (MFA) adds another layer of security, requiring users to verify their identity through multiple methods, such as a password and a one-time code sent to their phone.

Banks also employ fraud detection systems that monitor transactions for suspicious activity, and they regularly update their security systems to counter emerging threats.

Understanding these security measures is the first step in protecting yourself while using digital banking platforms.

Use Strong and Unique Passwords

Passwords are the first line of defense against unauthorized access to your digital banking accounts. A strong password is essential for ensuring your financial information remains secure.

Avoid easily guessed passwords like “123456” or “password”. Instead, create strong passwords that are at least 12 characters long and include a combination of:

- Uppercase letters

- Lowercase letters

- Numbers

- Symbols

Furthermore, it’s crucial to use unique passwords for each of your online accounts, including your digital banking platform. This prevents a security breach on one platform from compromising all your other accounts.

Consider using a password manager to help you generate and securely store complex passwords. These tools simplify password management while significantly enhancing your online security.

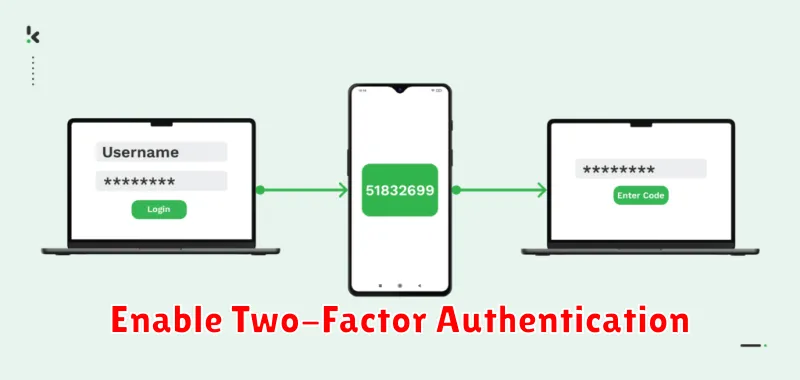

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your digital banking accounts. It requires two different factors to verify your identity before granting access. This typically involves something you know (like your password) and something you have (like a one-time code sent to your phone).

Even if a cybercriminal obtains your password, they won’t be able to access your account without the second factor. This significantly reduces the risk of unauthorized access.

Most banks offer several 2FA methods. These often include:

- Authenticator Apps: These apps generate time-based one-time passwords (TOTPs).

- SMS Codes: A unique code is sent to your mobile phone via text message.

- Hardware Tokens: These physical devices generate one-time passwords.

Check with your bank to see which 2FA methods they support and choose the option that best suits your needs. Enabling 2FA is a crucial step in protecting your financial information.

Watch for Phishing Attempts

Phishing is a common tactic used by cybercriminals to steal sensitive information, including your online banking credentials. These attacks typically involve deceptive emails, text messages, or websites that appear legitimate, often mimicking your bank’s branding.

Be wary of any unsolicited communication requesting your login details, account numbers, or other personal information. Never click on links or open attachments in suspicious emails or texts. Instead, navigate directly to your bank’s official website by typing the address into your browser.

Pay close attention to the website address. Look for “https” in the URL and a padlock icon in the address bar, indicating a secure connection. Phishing websites often use slightly altered URLs or misspellings to trick you.

If you suspect a phishing attempt, report it to your bank immediately.

Avoid Public Wi-Fi When Logging In

Public Wi-Fi hotspots are often unsecured. This means your data is vulnerable to interception by cybercriminals. Avoid accessing your digital banking accounts, or any sensitive information, while connected to public Wi-Fi.

If you absolutely must use public Wi-Fi, consider using a Virtual Private Network (VPN). A VPN creates an encrypted connection, making it much more difficult for hackers to steal your information. Ensure the VPN you select is reputable and provides strong encryption.

Consider using your mobile phone’s data connection as a safer alternative to public Wi-Fi. Most cellular data connections are encrypted and offer a higher level of security than open Wi-Fi networks.