In today’s fast-paced digital world, managing finances effectively is more crucial than ever. Digital banking offers a powerful suite of tools and features designed to help individuals cultivate better saving habits. This article explores how digital banking platforms are transforming the way we save, making it easier, more accessible, and ultimately, more rewarding to achieve our financial goals. From automated savings plans to real-time budgeting tools, the advantages of digital banking empower users to take control of their finances and build a more secure financial future. Learn how to leverage the power of digital banking to develop better saving habits and achieve your financial aspirations.

The convenience and accessibility of digital banking have revolutionized personal finance management. With features like instant account balance checks, automated bill payments, and personalized budgeting tools, individuals can gain a comprehensive understanding of their spending patterns and identify areas for improvement. This article delves into the specific ways digital banking promotes better saving habits by providing users with the tools and resources they need to track expenses, set savings goals, and monitor progress. Discover how digital banking can empower you to develop and maintain better saving habits, paving the way for greater financial stability and long-term success.

Automated Savings Transfers

One of the most effective features of digital banking for boosting savings is the automated savings transfer. This tool allows you to schedule recurring transfers from your checking account to your savings account. By automating the process, you essentially “pay yourself first,” consistently setting aside money before you’re tempted to spend it.

You can customize these transfers to align with your pay schedule and budget. For example, you might set up a transfer of a specific dollar amount on your payday or a percentage of each paycheck. Small, regular transfers can accumulate significantly over time, demonstrating the power of consistent saving, even with modest amounts.

Automated transfers remove the friction and mental effort involved in manually moving money to savings. This “set it and forget it” approach makes saving effortless and helps you build a healthy savings habit without constant vigilance.

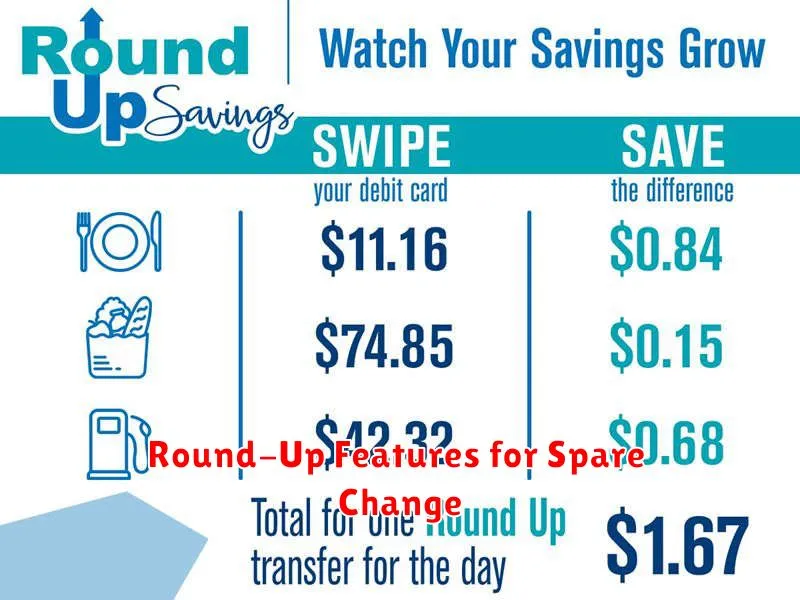

Round-Up Features for Spare Change

Many digital banking platforms offer a “round-up” feature, a convenient tool that contributes to savings effortlessly. This feature rounds up every purchase to the nearest dollar and transfers the difference into a designated savings account. For example, a $4.55 coffee purchase would result in $0.45 being transferred.

While seemingly small, these micro-transactions can accumulate significantly over time. Consistency is key to the success of this savings strategy. Small amounts saved regularly build up more effectively than sporadic, larger deposits. This makes round-up features particularly beneficial for individuals who struggle with traditional saving methods.

Some banks offer customizable round-up options. You might choose to round up to the nearest $5 or $10 increment for a more accelerated approach. Certain platforms even offer multipliers allowing you to double or triple the round-up amount. These features provide flexibility and control over your savings growth.

Visual Goal Trackers

Many digital banking platforms incorporate visual goal trackers. These tools allow users to set savings goals, assign images to them (like a new car or a down payment on a house), and monitor their progress visually. This visual representation of progress can be highly motivating.

Seeing the progress bar fill up or a designated image get closer to being “unlocked” provides a sense of accomplishment and encourages users to continue saving. The ability to personalize these goals with custom names and target amounts further reinforces the user’s commitment.

Instant Insights into Spending

Digital banking platforms provide real-time updates on account balances and transaction history. This immediate feedback is crucial for fostering better spending habits. No longer do users need to wait for monthly statements to understand their financial activity.

Many platforms offer visualizations of spending patterns, categorized by areas such as groceries, dining, or entertainment. These tools offer clear insights into where money is going, empowering users to identify areas for potential savings.

Automated budgeting tools often accompany these features. Users can set spending limits for different categories and receive alerts when approaching those limits. This proactive approach helps prevent overspending and encourages more mindful financial decisions.

Motivational Notifications and Rewards

Digital banking apps often incorporate features designed to encourage positive saving behaviors through motivational notifications and rewards. These features leverage principles of behavioral economics to nudge users towards their financial goals.

Notifications can serve as helpful reminders. For example, the app might send a notification when a user is approaching a savings goal, or alert them to a potential budget overspend. These timely prompts can help users stay on track and make informed financial decisions.

Rewards can further incentivize saving. Some digital banks offer cashback rewards for reaching savings milestones, or provide discounts on other financial products. These incentives create a positive reinforcement loop, making saving feel more rewarding and encouraging continued engagement with the platform.