Financial inclusion is a critical aspect of economic development, enabling individuals and businesses to access essential financial services. Traditionally, access to these services has been limited for many, particularly those in underserved communities. However, the emergence of digital banks is transforming the financial landscape and playing a vital role in expanding financial inclusion globally. Digital banks leverage technology to provide a wide range of financial services, often at lower costs and with greater accessibility than traditional banking institutions. This makes them a powerful tool for reaching underserved populations and promoting financial inclusion.

This article will explore how digital banks are supporting financial inclusion through innovative solutions and strategies. We will examine the key features of digital banks that contribute to greater accessibility, such as lower fees, simplified account opening processes, and mobile-first platforms. Additionally, we will discuss the impact of digital banks on underserved communities, highlighting the ways in which they are empowering individuals and businesses with crucial financial tools. The growing role of digital banks in fostering financial inclusion offers a promising path toward a more equitable and accessible financial system.

Access to Underserved Communities

Digital banks are uniquely positioned to reach underserved communities, often excluded from traditional banking systems. Their lower overhead costs and digital-first approach allow them to operate profitably while serving populations that might be considered unprofitable by brick-and-mortar institutions.

This access is particularly impactful in areas with limited physical bank branches, such as rural communities and developing nations. Mobile banking makes financial services available to individuals who previously faced geographical barriers.

Furthermore, digital banks can tailor products and services to the specific needs of these communities. For example, offering micro-loans or micro-savings accounts can empower individuals traditionally excluded from mainstream finance. This can be particularly important for women, minorities, and low-income individuals who often face systemic barriers to financial access.

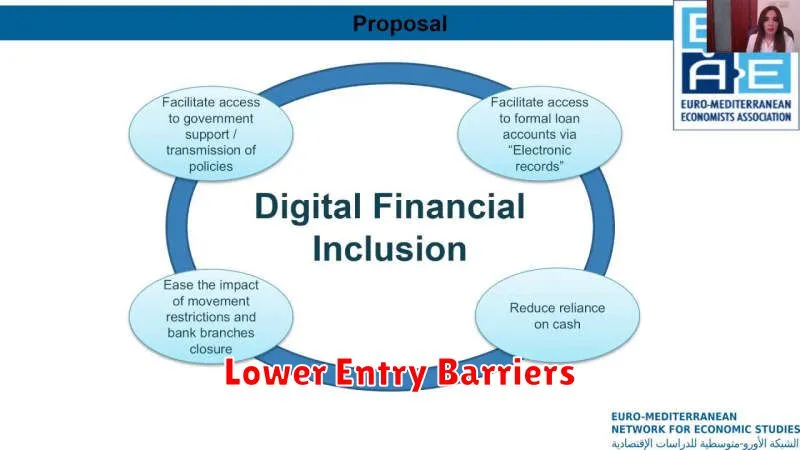

Lower Entry Barriers

Traditional banks often impose several requirements that can exclude a significant portion of the population. These can include minimum balance requirements, proof of address, credit history checks, and in-person branch visits. Digital banks are dismantling these barriers by leveraging technology.

Reduced Documentation: Digital onboarding processes often require minimal documentation, sometimes only needing a government-issued ID. This simplifies the process, especially for those who lack traditional documentation.

Low or No Minimum Balances: Many digital banks eliminate or significantly reduce minimum balance requirements, making it easier for low-income individuals to open and maintain accounts.

Remote Account Opening: The ability to open an account entirely online or through a mobile app eliminates the need for physical branch access, which is a major benefit for those in underserved or remote areas.

Multilingual and Easy-to-Use Apps

Digital banks often prioritize creating apps that are accessible to a wider audience. This includes developing interfaces in multiple languages, catering to diverse populations.

User-friendly design is another crucial element. Simplified interfaces, intuitive navigation, and clear instructions make these apps easier to use, particularly for individuals with limited digital literacy or those unfamiliar with traditional banking.

Features like voice commands and visual aids further enhance accessibility. These design choices contribute significantly to greater financial inclusion by removing barriers to entry for previously underserved populations.

Reduced Fees for Low-Income Users

A key aspect of digital banks’ contribution to financial inclusion is the implementation of reduced or waived fees for low-income customers. Traditional banks often impose minimum balance requirements, monthly maintenance fees, and transaction charges that can be prohibitive for individuals with limited financial resources. Digital banks, operating with leaner cost structures, are often able to offer significantly lower fees or eliminate them altogether.

This reduced fee structure can be particularly impactful for those living on the margins. By removing the financial barrier of banking fees, digital banks enable low-income individuals to access essential financial services such as direct deposit, bill payment, and money transfers. This access can facilitate better financial management, savings accumulation, and participation in the formal economy.

Some common examples of reduced fees offered by digital banks include:

- No monthly maintenance fees

- Free or low-cost ATM withdrawals

- Waived overdraft fees (in some cases)

- No minimum balance requirements

These policies help to ensure that cost is not a barrier to financial participation for vulnerable populations.

Partnerships with Government Initiatives

Digital banks are increasingly partnering with government initiatives to further financial inclusion. These collaborations leverage the technology and reach of digital banks with the policy frameworks and mandates of government programs. This synergistic approach can effectively address challenges in reaching underserved populations.

Governments often have established programs focused on distributing social welfare benefits, promoting small business growth, and expanding access to financial services in rural areas. Digital banks, with their agile infrastructure, can facilitate these initiatives by providing the platform for efficient and transparent disbursement of funds.

These partnerships can take several forms, including:

- Integrating with government identification systems for simplified onboarding.

- Utilizing digital banking platforms for distributing social benefits and subsidies.

- Collaborating on financial literacy programs targeted at specific demographics.