In today’s fast-paced digital world, managing finances effectively is more critical than ever. Budgeting tools offered by digital banking platforms provide a powerful and convenient way to track spending, save money, and achieve financial goals. These digital budgeting tools offer a range of features, from real-time expense tracking and automated savings plans to personalized financial advice and sophisticated reporting. Leveraging these integrated digital banking tools can empower you to take control of your finances and make informed decisions about your money.

This article will explore the numerous benefits of using budgeting tools in digital banking. We’ll delve into how these tools can simplify money management, reduce financial stress, and pave the way for a more secure financial future. Discover how the convenience and accessibility of these digital budgeting tools can transform your financial habits and help you achieve your budgeting objectives, whether it’s saving for a down payment, paying off debt, or simply gaining a better understanding of your spending patterns. Embrace the power of digital banking and unlock your financial potential.

Track Every Expense Automatically

One of the most significant advantages of budgeting tools integrated within digital banking platforms is the ability to automatically track every expense. This eliminates the need for manual entry and reduces the risk of errors. Transactions are categorized and recorded in real-time, providing a constantly updated overview of your spending habits.

This automated tracking allows you to easily monitor where your money is going. You can quickly identify areas of overspending and adjust your budget accordingly. This level of control empowers you to make informed financial decisions and stay on top of your finances.

Visualize Spending Habits

Budgeting tools within digital banking platforms often provide visual representations of your spending. These visualizations can take many forms, such as pie charts, bar graphs, and line graphs, making it easier to grasp where your money is going.

Instead of sifting through pages of transactions, you can quickly identify spending trends and patterns. For example, a pie chart might reveal that a significant portion of your monthly expenses goes towards dining out. This visual representation allows you to quickly assess if this aligns with your financial goals.

Many tools also allow you to categorize your spending (e.g., groceries, entertainment, transportation). This categorization combined with visual aids provides a clearer picture of your financial habits, empowering you to make informed decisions about your budget.

Set Savings Goals

Budgeting tools within digital banking platforms often include features designed to help you establish and track savings goals. Defining clear objectives, whether for a down payment on a house, a new car, or a vacation, makes saving more purposeful.

These tools allow you to set target amounts and deadlines. By inputting this information, the application can calculate how much you need to save regularly to reach your goal. Some even offer automated savings features, transferring funds automatically at specified intervals.

Visualizing your progress towards your savings goals is another key advantage. Many tools visually represent your progress with charts and graphs, offering a motivating snapshot of how your savings are accumulating over time. This can help you stay engaged and committed to reaching your financial objectives.

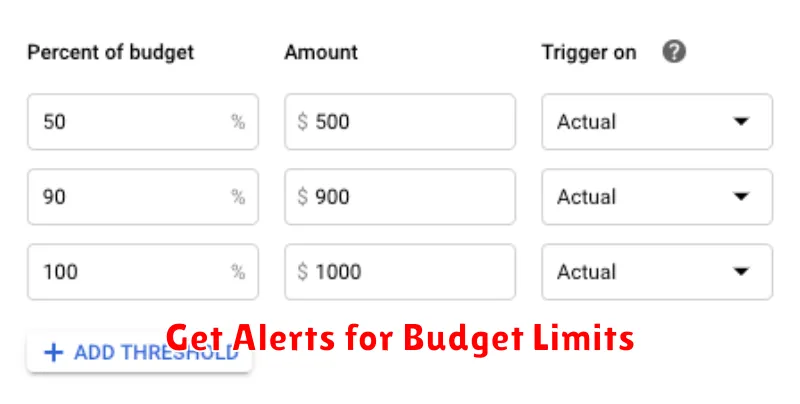

Get Alerts for Budget Limits

A key benefit of using budgeting tools in digital banking is the ability to set budget limits and receive timely alerts. This feature empowers you to stay within your predefined spending boundaries and avoid overdraft fees or unwanted debt.

You can typically set limits for various categories, such as dining, groceries, entertainment, or overall spending. When your transactions approach or exceed the specified threshold, the digital banking tool will send you a notification. This could be through an email, SMS message, or a push notification directly within the banking app.

These alerts provide real-time awareness of your spending habits, enabling you to make informed financial decisions. They serve as a valuable reminder to adjust your spending if necessary and maintain control over your finances.

Integrate with Other Financial Tools

Modern budgeting tools within digital banking platforms often offer seamless integration with other financial tools. This interconnectivity enhances the overall financial management experience.

One key advantage is the ability to connect to external accounts. This allows users to view transactions and balances from various institutions in one centralized location, providing a holistic view of their financial standing. This aggregated data empowers users to make more informed decisions about spending and saving.

Furthermore, some budgeting tools integrate with investment platforms. This connection facilitates tracking investment performance alongside daily spending habits, enabling users to monitor their overall financial progress towards their goals.